The New 1040 Tax Form – What It Is, How It Works

March 11, 2023The IRS works hard to make sure US taxpayers file their taxes. As a result, it has made filing taxes easier by creating a brand new 1040 form. As you know, some years back taxpayers in the US used the 1040EZ, the 1040A and the 1040. However, to make filing tax easier, you can now use the new 1040 tax form as well as the 1040-SR for senior citizens aged 65 years and above. To help you understand the new form, continue reading.

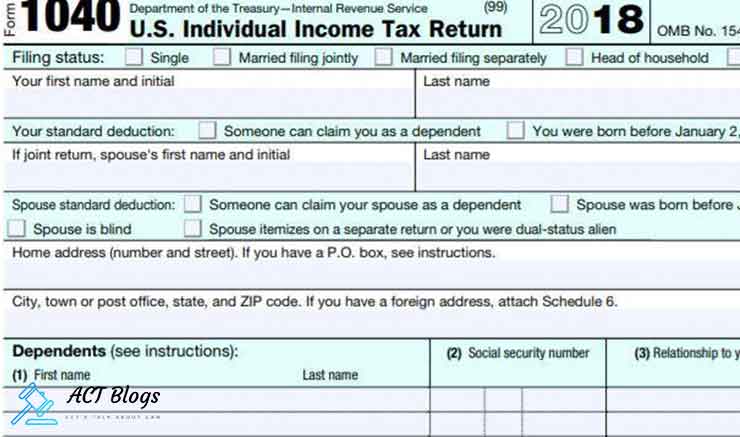

What is Form 1040?

This is a standard tax form people use when filing taxes with the IRS. In other words, it is the standard federal income tax form taxpayers use to claim tax deductions and credits, report their income, and calculate the tax bill or tax refund for the year. Some years back, people used complex forms that required a lot of details, making it too difficult for taxpayers to file their returns. However, with the new Form 1040, things have changed.

Is Form 1040 same as Form 1040-SR?

No, these are two different forms, but they serve the same purpose- filing taxes. The Form 1040 is for all taxpayers that qualify for filing tax returns. On the other hand, Form 1040-SR, is the new version of 1040 form but for people aged 65 years and above. It works just like regular Form 1040 in calculating your tax credits and the taxes you have already paid, and determine if they cover your tax bill.

How Form 1040 works

As mentioned, new 1040 tax forms aim to help you file taxes easily and accurately. Here is what the form does;

Asks who you are – The form has a section at the top where you fill in all your basic information. You will have to fill in your name, what filling status you will use, dependents you have, among other details. You have to fill in the details correctly to avoid errors.

Calculates your taxable income – Here, the forms main objective is to calculate your taxable income that is subject to income tax. In short, it calculates all of your income that year and deductions you would like to claim.

Calculates your tax liability–Close to the bottom of Form 1040, you will fill in the amount of income tax you are responsible for. You have to subtract the tax credits you might qualify for, and any taxes you have already paid through withheld taxes.

Determines whether you have already paid all or some of your tax bill – The form will help determine if you withholding taxes and credits cover your tax bill. If they don’t, you will have to pay the rest when you file your tax form. On the other hand, if you have paid more than the required tax, you will get a refund. The form has a spot for you to tell IRS where to send your refund.

Final Words

Filing taxes in the US has become easy thanks to the new Form 1040 and Form 1040-SR. Also, filing taxes online has made the process easier and accurate. Therefore, use certified online tax programs or software like H&R Block, or TurboTax when filing your taxes, and you will not be disappointed.