Learn About Filing Taxes in Quick and Easy Steps: Tax Form 1040 & Instructions

April 18, 2023Tax season is right around the corner, and many people have questions about the forms they need to complete. The first step to filing your taxes correctly is to understand what types of forms you need and how to complete them. Here is a quick guide to help you get started with filing your personal tax form on time.

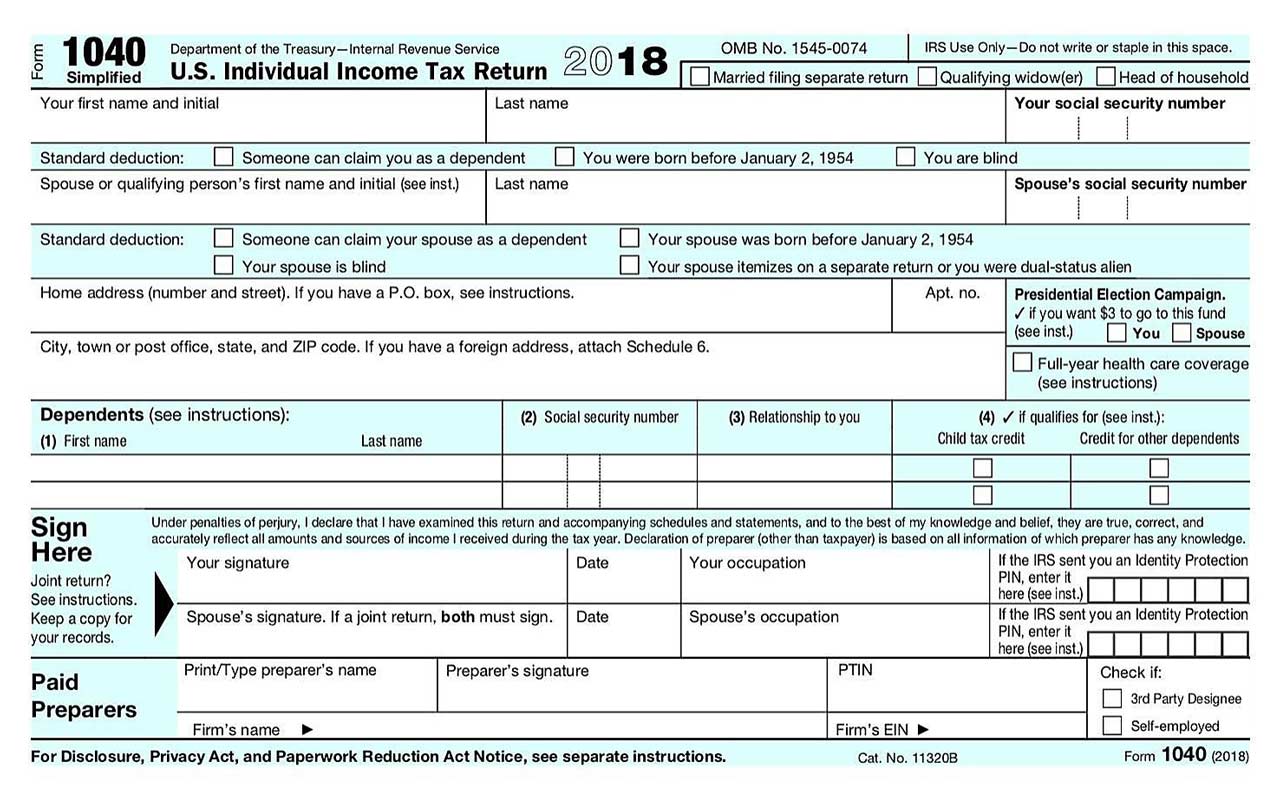

The Basics of Form 1040

Form 1040 is the form that taxpayers use to file their annual federal income tax returns. The form is divided into several sections, including income, deductions, credits, and taxes.

When to File Form 1040

There is no one perfect answer to the question of when to file Form 1040. The form can be filed any time during the year after the taxpayer’s tax liability has been incurred.

What to Include on Form 1040

There are a number of items that you will need to include on your Form 1040. You will need to report your income, your deductions, and your tax liability.

How to Report Income on Form 1040

To report income on Form 1040, taxpayers will need to gather their W-2 and 1099 forms. They will need to list their income from all sources, including wages, salaries, tips, and self-employment income. They will also need to report any interest or dividend income, as well as any capital gains or losses.

How to Report Deductions and Credits on Form 1040

Form 1040 is used to report income, deductions, and credits. The form includes a worksheet to help taxpayers calculate their taxable income.

How to Complete the Schedule A

A Schedule A is a form used to list your income and expenses. To complete Schedule A, you will need to know your total income and your total expenses. You can find your total income by adding together all of your sources of income. To find your total expenses, add together all of your expenses. Once you have your total income and your total expenses, you will need to subtract your total expenses from your total income.

How to Complete the Schedule C

The Schedule C is a form used to report income and expenses from a business. It is used to calculate the profits or losses from a business. To complete Schedule C, you will need to gather information about your business income and expenses.

Tax Tips for Preparing Your 1040 Tax Form

If you are preparing your 1040 tax form, there are a few tips to keep in mind. First, make sure you have all of the necessary information to complete the form. This includes your Social Security number, income information, and deductions. Second, be sure to use the correct form. The 1040 form is for individuals, while the 1040EZ is for those with a more simplified tax return.

How to Fill Out Your 1040 Tax Form

The 1040 tax form is one of the most common forms used to file taxes in the United States. The form is used to report income, deductions, and credits. In order to complete the form, you will need to know your income, exemptions, and deductions.

When Do I Need to File My 1040 Tax Form?

The deadline for filing your federal income tax return is April 15th. However, if you live in Maine or Massachusetts, the deadline is April 17th because of the Patriots’ Day holiday.

How to Get a Copy of Your 1040 Tax Form

You can get a copy of your 1040 tax form by visiting the IRS website or by contacting the IRS directly. The IRS website offers an online form that you can fill out and submit to request a copy of your tax form. You can also call the IRS directly and request a copy of your form.

1040 Tax Form Frequently Asked Questions

If you are unsure about how to complete your 1040 tax form, you may have some questions. The following are some of the most frequently asked questions about the 1040 tax form:

- What is the deadline for filing my 1040 tax form?

The deadline for filing your 1040 tax form is April 15th. However, if you are unable to file by the deadline, you may be able to file for an extension.

- What is the penalty for late filing my 1040 tax form?

There is a penalty of five percent of the amount that is due unless you are outside of the United States on the date that the tax form is due, in which case there is no penalty.

- What is a 1040A tax form?

The 1040A form is used by individuals who have income from a pass-through entity, such as an LLC or partnership. It is used to report income from business partnerships, such as independent contractors and sole-proprietors. The 1040A also includes a worksheet to determine the amount of additional tax owed based on Schedule E savings.

The deadline for filing your federal income tax return is April 15th. The 1040 tax form is one of the most common forms used to file taxes in the United States. The form is used to report income, deductions, credits, and taxes. The answer to the question of when to file Form 1040 is not always clear. However, the sooner you file, the sooner you will receive your refund (if you are eligible for one).