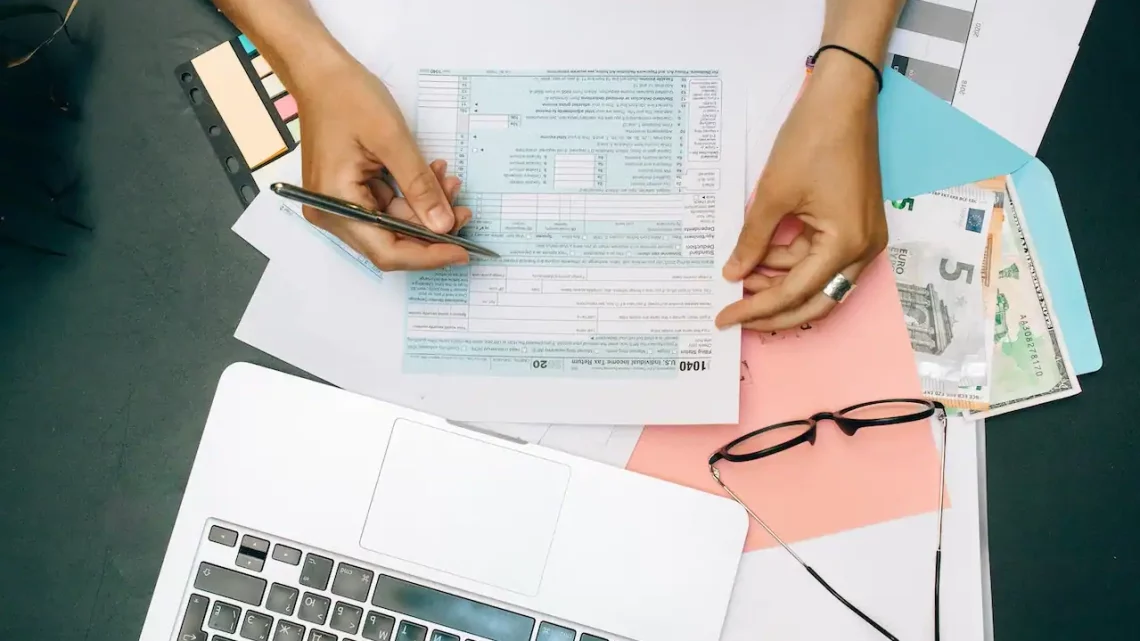

1040a Tax Form: How to Get the Most Out of It

August 14, 2023The 1040a Tax Form is one of the most popular tax forms used by taxpayers. It’s a shorter form than the 1040, and it’s simpler to use. However, it’s still important to know how to get the most out of the 1040a Tax Form. Here are some tips to help you maximize your deductions and get the most out of your 1040a Tax Form.

The 1040a Tax Form is a shorter, simpler version of the standard 1040 form that most taxpayers use. It can be a good option for those who have a relatively simple tax situation and don’t need to itemize their deductions. The 1040a Tax Form can help you get the most out of your tax return by ensuring that you claim all the credits and deductions you’re entitled to. It can also help you avoid mistakes that could result in a smaller refund or a larger tax bill. If you’re not sure whether the 1040a Tax Form is right for you, talk to a tax professional or use the IRS’s online tool.

How to fill out the 1040a form

The 1040a Tax Form is a great way to get the most out of your taxes. Here’s a step-by-step guide on how to fill it out:

- Enter your personal information at the top of the form . This includes your name, address, and Social Security number.

2. List all your income sources on the next page. Include all of your wages, tips, commissions, and other income.

3. Add any deductions you’re entitled to. This includes things like mortgage interest, state and local taxes, and contributions to retirement accounts.

4. Complete the rest of the form according to your tax situation. If you’re filing jointly with your spouse, list each person’s income, deductions, and credits on the form.

What deductions can be taken on the 1040a form

The 1040a is a shorter, simpler version of the 1040 tax form. It can be used by filers who have relatively simple tax situations. The 1040a allows filers to claim the standard deduction, as well as a few other common deductions, such as the deduction for educator expenses. filers can also claim certain credits on the 1040a, including the child and dependent care credit and the earned income credit.

How to file the 1040a form

The 1040a is a form used by the IRS for individual taxpayers. It is shorter and simpler than the standard 1040 form, and can be used by people with fairly simple tax situations. The 1040a allows you to claim a few different types of deductions and credits, which can lower your overall tax bill. If you think you might be eligible to use the 1040a, it’s worth taking the time to learn more about it and how it can benefit you.

Tips for getting the most out of the 1040a form

The 1040a is a shorter, simpler version of the 1040 tax form. It can be used by filers who have relatively straightforward tax situations. If you’re eligible to use the 1040a, it can save you time and effort when filing your taxes. Here are some tips for getting the most out of the 1040a form:

- Make sure you’re eligible. The 1040a is only available to filers with certain types of income, such as wages, salaries, tips, and interest. If you have other types of income, such as self-employment income or capital gains, you’ll need to use the longer 1040 form .

2. Review your deductions. The 1040a allows you to claim a few different types of deductions, including the standard deduction, the deduction for educator expenses, and the child and dependent care credit. This can help you save money on your taxes.

3. Compare your tax situation to the standard deduction. The 1040a allows you to claim a lower standard deduction than the one available on the 1040 form. This can help you save money if you’re eligible for the standard deduction.

4. File electronically. The 1040a can be filed electronically using the IRS’s e-file system. This can save you time and hassle when filing your taxes.

The 1040a Tax Form is one of the most popular tax forms used by taxpayers. It’s a shorter form than the 1040, and it’s simpler to use. However, it’s still important to know how to get the most out of the 1040a Tax Form. Here are some tips to help you maximize your deductions and get the most out of your 1040a Tax Form.